Entertainment rights management has always been complex, with tracking required on so many variables—geography, currencies, languages, contract timelines, and more. The advent of new distribution channels has increased complexity exponentially, and systems of the past are not designed to handle the challenges surrounding fast channels, streaming services, Over the Top (OTT) distribution, video-on-demand (VOD) contracts, and more. Unfortunately, this complexity can wreak havoc on your bottom line if you're not able to fully track and monetize your library.

But just because entertainment rights and their associated financials are complex doesn’t mean managing them has to be.

The Evolution of Rights Management

Historically, tracking rights in the entertainment industry was relatively straightforward, as most films were made to be released only or primarily in the country of origin. It wasn’t until the 1930s that subtitled films using multiple languages could be distributed worldwide. Even then, a simple spreadsheet could track film rights quite effectively. However, major technological advancements have opened the floodgates to vast new distribution potential for films and television series; spreadsheets can no longer keep up.

Even if you have a financial management or accounting system in place and keep your distribution data separate from your financial data because your system doesn't account for the complexities of digital distribution, your system likely wasn't built for today's entertainment industry. As a result, these two systems must be cross-referenced every time you want to make a deal, opening the door to costly human error and lost revenue.

To optimize the monetization of your library, you must eliminate manual processes like spreadsheets in favor of one single source of truth.

Finding a tool that integrates with your financial business systems is not the only critical component for managing entertainment rights. At a minimum, you need to assess a solution’s viability and ensure you are partnering with a vendor that can grow with your business needs. Small, medium, and large companies alike should look for solutions that not only support you now…but down the road as well.

Evaluating a Rights Management System - Feature Considerations

The rapid rise of digital entertainment has made rights management more complicated than ever before. As a result, modern solutions need to be flexible, efficient, secure, and streamlined. Here are some of the key functionalities that companies should look for in a rights management platform:

Royalties

A solution with a built-in royalties engine can automatically perform the following tasks:

- Recognize revenue based on multiple actioned triggers

- Ingest multi-currency royalties

- Auto-calculate revenue share based on clear royalty definitions

- Track allocations among all vectors to ensure timely payments

- Track consumption against money already received

- Utilize aging reports to identify outstanding invoices

Participations

When the contract and rights workflow connects to royalties and participations, businesses can easily accomplish the following:

- Calculate the amount owed to participants based on agreed-upon contract terms through calculation definitions

- Report revenue participation back to licensors or participant stakeholders

- Define pre- and post-recoupment tiers

- Ingest internal exploitation revenue

- Manage expense cap reductions and reserves

Financials

Legacy systems typically can’t manage the following detailed financial functions that a modern rights management system can, including:

- Setting unique invoice workflows by deal type or separate schedule items within a contract

- Applying payments with unique payment, bank, and base currencies

- Accessing transactional accounting records and account structures in line with GAAP compliance

- Using event-based triggers to calculate contractual, invoice, and revenue dates

- Applying cash from a single payment across multiple invoices

- Tracking late payments

- Replicating contractual items

- Reviewing and assessing scheduled collection amounts

- Utilizing billing groups to cross-collateralize your projects

- Allocating advances in fees across multiple vectors

- Managing fee collections for VOD platforms

- Recognizing revenue based on the new 2018 rules

Advanced Financials

Advanced financials allow your team to handle complex billing scenarios with ease. With the following functionalities, you’ll be confident in knowing exactly what is owed, without just taking their word for it. You should be able to:

- Use date triggers to automatically schedule items and invoice due dates

- Handle advances, guarantees, and fees within the same contract

- Track royalties and participations against advance and guarantee invoices

- Set up multiple revenue recognition methods within the same contract

- Autogenerate revenue cards on contract posting

- Access general ledger and aux ledger capabilities

- Create and email invoice documents in PDF format

- Allocate billing schedules, revenue cards, and invoices across all vectors and project category

Assessing the Stability and Capabilities of Rights Management Vendors

Successful companies of all sizes focus on forming mutually beneficial partnerships with vendors, and working with financially stable companies is critical. While price is always a consideration when contracting with vendors, businesses must also recognize the risk of partnering with a supplier who could fail to deliver key services to the organization because of undisclosed financial or other issues.

To minimize your overall business risk, you should additionally avoid partnering with vendors who might expose your company to negative consequences like reputational damage and potentially impair your ability to deliver on contracts. Here are some financial red flags to look for when vetting the financial stability of a potential rights management vendor:

- Limited bandwidth to properly service your global customer base.

The entertainment rights management industry (and hopefully your company) is growing rapidly. As your rights library expands, will this vendor be able to keep up? - Failure to expand the capabilities of their product suite.

Choose a vendor passionate about building rich new features in their technology. If the company isn't updating regularly, appears to have no vision for the future, or isn't willing to share such details with you, reconsider choosing them.

Research and development can determine a vendor’s ability to merely survive or thrive. Therefore, it is critical that rights management software vendors do not become stagnant and instead continue to innovate to deliver new solutions and services. - Inability to invest in proper data security protocols and certifications.

When a vendor does not have the appropriate data security protections in place, this failure can lead to data compromise, a cybersecurity breach, or worse. Look for the certifications and request a security review if necessary. - Questionable credit history.

There are few things worse than signing on with a vendor only to have them go out of business, leaving you with an unsupported software program. To avoid this situation, run a credit report, review the company’s third-party financial statements, and call their references (don’t just request them)– take the time to speak to someone.

If you are venture capital or private equity-backed, you should request to see the burn rate of the vendor to garner visibility into how much financial runway is left before they may have to raise another round of funding. - Price structure that “nickels and dimes” customers.

A relationship with a technology vendor should be built on trust, but when companies start sneaking unexpected fees into their invoices, the relationship can quickly become tenuous. As a best practice, look for a company that charges an initial setup fee followed by a monthly charge to keep the system operational. - Lack of formal business continuation plan.

Weather emergencies and other unanticipated downturns happen. Find out how this vendor plans to support its customers in the event of a crisis, whether it’s technical or otherwise (we see you, pandemic of the future.)

If you perceive a problem with a current or prospective technology partner, don’t wait to get it addressed. The rights management industry is evolving rapidly, and there’s no time to lose if you want to stay ahead of your competition. The best ways to ensure that a vendor will support your rights management needs are:

A) Be aware of the risks

B) Take note of dips in performance

C) Monitor a potential partner's financial health before you decide on a solution

Moreover, every investor in a film should insist that these costs be part of a project and company's business plan. Producers should disclose this upfront to investors in their initial offering documents. Investors should split the fees proportionally yearly to ensure that rights are fully exploited, distribution is tracked, and money is collected.

Moreover, every investor in a film should insist that these costs be part of a project and company's business plan. Producers should disclose this upfront to investors in their initial offering documents. Investors should split the fees proportionally yearly to ensure that rights are fully exploited, distribution is tracked, and money is collected.

Difficulties with Assessing Rights Management Companies

Whether you’re getting ready to deploy your first rights management system or are experiencing exponential growth that your system cannot handle, there is one crucial thing to remember when evaluating an entertainment rights management system: Don’t get fooled by a splashy demo.

Although your current system (or the one you are assessing) may seem to have everything you need, in time, your library will (hopefully) grow, and your tracking requirements will become more complex. Your solution needs to scale and give you visibility of your assets on a granular level.

Many rights management companies claim they can keep up with the industry but fail to measure up. To avoid partnering with the wrong system, you must look beyond product demos and dig deeper before taking the plunge. Here are some steps to take:

- Do a test run.

Set up a meeting with the vendor and ensure you get a solid demonstration of the software before engaging them. Insist that they ingest your contracts and run the reports you need to maintain your business. Determine how calculations and currency conversions are performed to ensure their process is thorough and secure.

- Get the history.

Establish how long the company has been in business. The company should have expertise in the entertainment rights management industry - some heavy-hitter tech companies have tried their hand at managing entertainment rights and failed. Experience is crucial due to the nuances of the industry, and having a respected thought leader behind the technology is a significant advantage. - Gauge viability.

If a company is publicly traded, you can estimate its viability in its quarterly and annual reports. Private companies aren’t required to make such filings, although they must make similar calculations when filing taxes. However, whether they are willing to disclose profitability will depend on various factors, including how healthy their numbers are. - Demand real flexibility.

Look for a company that builds flexibility into its rights management system by allowing revenue streams from new distribution sources as they arise. Such updates should be prompt. Disruptions to the industry happen, and you should partner with a vendor that can readily adjust and not cause you to lose out on financial opportunities. - Evaluate capacity.

Verify a company’s global reach and the number of customers they routinely service to determine whether they can grow with your company. However, if a tech company’s customer churn is at twice the industry rate, this might indicate a service quality or customer-support issue, which could put your organization at risk.

Questions to Ask When Assessing a Rights Management Company

When shopping for a rights management system, you should put together a list of questions that need to be answered before making an informed decision. Based on the considerations above, here are some probing questions to consider:

Security and Compliance

- Are they SOC 1 and SOC 2 compliant?

SOC compliance demonstrates that an organization maintains a high level of information security. SOC 1 focuses on service organizations' controls over financial reporting, while SOC 2 examines a service organization's controls based on the Association of International Certified Professional Accountants (AICPA) trust principles: security, availability, processing integrity, confidentiality, and privacy. - More generally, what certifications/protocols or other security measures are in place?

Although no technology platform is entirely resistant to malicious attacks, ensure your prospective vendor has made every effort to solidify its physical server environment and code base. Also, ask to see recent 3rd party security audits to see how threats were addressed and how quickly the vendor was able to patch the holes. - Do they perform annual audits?

Businesses in compliance operate within all the applicable laws and codes that pertain to their operations, as well as standards and policies set by the company's leadership. Rules, regulations, and ordinances change from year to year, so an annual compliance audit is highly desirable. - How does the platform handle geographical regulations?

Complying with the General Data Protection Regulation (GDPR) and other global privacy rules can be challenging. First, however, a rights management company needs to do the hard work of protecting the rights of its data subjects by performing impact assessments, reporting breaches and other security incidents, and having the proper auditing processes in place.

Platform Growth and Scalability

- What percentage of revenue is reinvested into R&D?

Most large enterprises invest heavily into research and development – Samsung spends $14.9 billion, Microsoft spends $13.6 billion, and Apple spends $10.7 billion. According to Industry Week, 13.6% is the average rate for the software and Internet industry.

For start-ups and growing software companies, Crunchbase says the rule of 40/20/20 should apply - 40% of revenue is spent on sales and marketing, 20% on product/R&D, and 20% on general and administrative expenses (G&A). - Is the solution flexible?

Of course, no two consumers are exactly alike, but today there’s one thing that nearly all of us have in common: the expectation of flexibility. And with that expectation comes the need for new ways to cater to and ultimately satisfy the modern media consumer and nearly all modern entertainment media companies. - What is their software development life cycle?

According to Soltech, the average time it takes to develop custom software ranges between four and nine months or more, depending on the size and complexity of the project. However, the more agile rights management companies generally issue new releases quarterly and one major release each year. - Will it scale with the business?

The platform you are considering should be configurable to the needs of your business. Avoid one-size-fits-all solutions: completely changing your technology because it can no longer handle your unique needs is time-consuming, frustrating, and expensive. You don’t want to find yourself shopping for new technology because you quickly outgrew the one you bought six months ago.

Not only does a rights management platform need to be prepared to handle the challenges of today’s royalty and licensing contracts, but it needs to be able to adapt to wherever the entertainment industry goes next. And as the last few years have shown us, we’re likely in for some plot twists and surprise endings.

FilmTrack's Financial Capabilities are Woven Deep Into Its Rights Management Platform

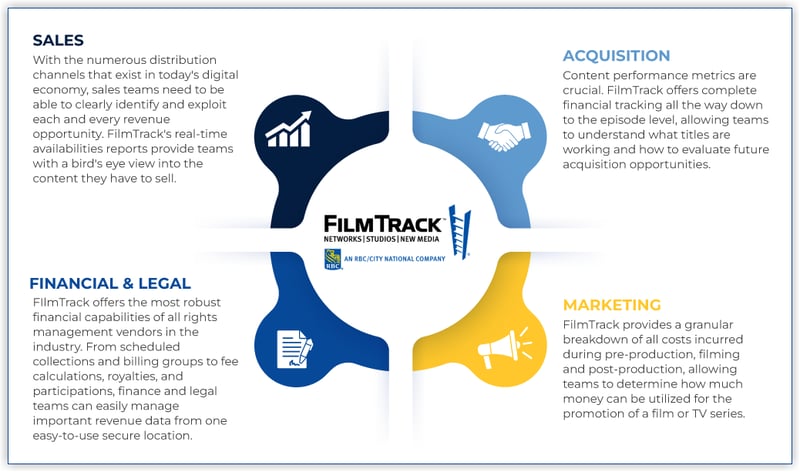

FilmTrack offers four core products designed to adapt and grow with your business. These functions are modular, meaning they can tie to your finances when the time is right for you to access that functionality. You pay for what your business needs.

The core functions of FilmTrack's Rights Management Platform are:

- Contracts and Availabilities Manager - Have all your contract data at your fingertips. You’ll know everything you have to sell, get every dollar available, and even find hidden availabilities you didn’t know you had.

- Financials Manager - Whether it’s circular deductions, financial waterfalls, or royalties in/out, you can relax and know that everything is being split and paid accurately.

- Brand Licensing Manager - Increase revenue, save time, and measure the success of your brand licensing program.

- Business Intelligence Manager - Connect to external data sources and get automatic live updates configured the way you want.

By housing critical financial information in a central repository, multiple departments - sales & marketing, acquisition, financial, and legal - can work independently but are connected through one source of truth. By implementing FilmTrack, you can eliminate barriers between departments, increase transparency, and improve productivity.